TOTAL CONSISTENCY

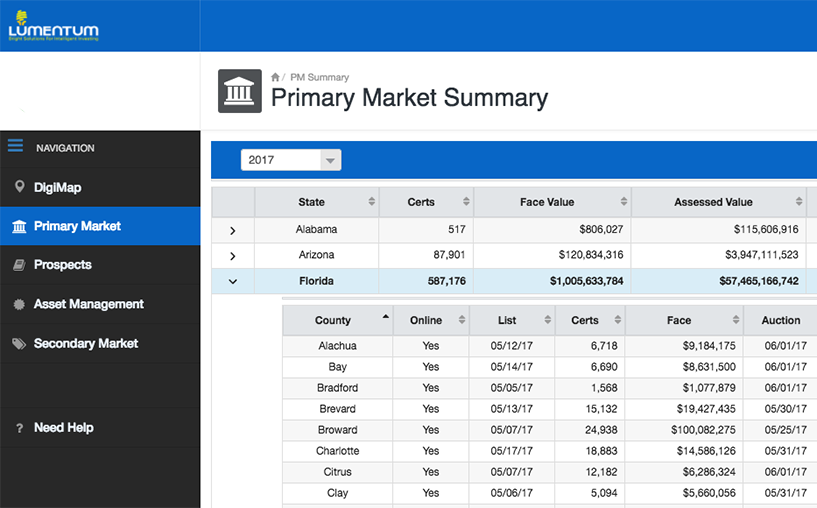

Lumentum tax lien data is formatted identically across all states, counties and municipalities.

All tax lien investors know the pain of gathering due diligence data on certificates and parcels. No two states or counties present the information exactly the same way, and aggregating and normalizing the data necessary to make informed decisions across multiple locations is extremely time-consuming – if it’s possible at all.

Not anymore. At Lumentum, we do the legwork for you, aggregating all data associated with a parcel – mortgage information, environmental data, back taxes, payment history and more – and presenting it to you in a standardized format. Spend your time executing on your investing strategies, not chasing down data from county or municipality websites.

Lumentum tax lien data is formatted identically across all states, counties and municipalities.

Our team is dedicated to delivering full datasets almost as soon as they’re released by state or county officials. If they make a change, we update our records, and let you know.

Due your work in our DigiPan due diligence platform, or export data directly into Excel or Google Sheets. You’ll never get unstructured.

Find out how Lumentum can do all the legwork for you and provide you with the most accurate and up-to-date tax lien data.